_Windfall Tax

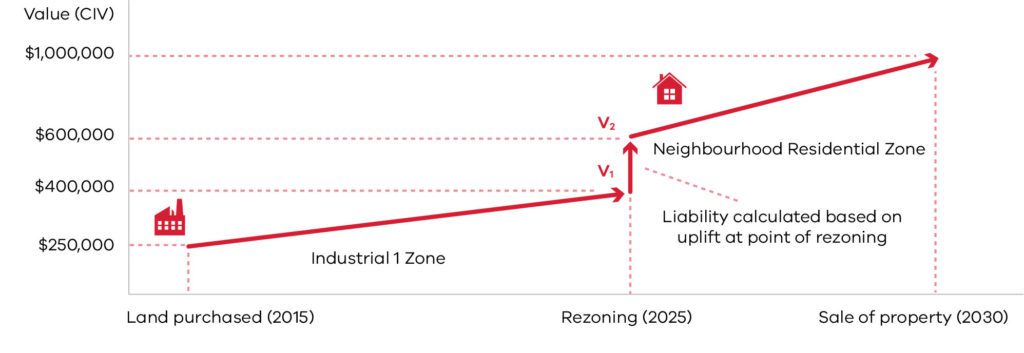

The Victorian State Government has introduced a new windfall gains tax that will be applied to land rezoned by a planning scheme decision made on or after July 2023, where the decision results in an increase in the value of land by $100,000 or more. The minimum rate of tax will be up to 50 per cent of the increased value.

Although legislation to support the proposed windfall gains tax has not been passed by State Parliament, the following provides a summary of what we understand to be proposed under the new tax.

- Where the increased value is $100,000 to less than $500,000, a tax rate of 62.5 per cent applies.

- Where the increased value is $500,000 or more, a tax rate of 50 per cent applies.

- The increased value will be calculated by the Valuer-General Victoria on the pre-rezoning value and post-rezoning value.

- A landowner becomes liable for the tax at the time of the rezoning but may choose to defer payment of the liability until the next dutiable transaction, when cash flow to meet the liability will be generated, with a 30-year limit being placed on deferrals.

- Some exemptions apply to the tax but these are limited to specific circumstances such as land rezoned to a rural zone or where related to charities.

- It is understood the tax generated will help contribute towards infrastructure and services required, although this is unclear.

Whilst Collie acknowledges that the funding and delivery of essential infrastructure to service new and developing communities is important, we question why in system where mechanisms already exist to capture this funding (such as GAIC and infrastructure contribution plan overlays), the windfall gains tax is required. It will be interesting to see what the final legislation looks like, assuming it is passed by State Parliament and in particular, how the tax does not become a further burden on affordable housing.

For further information about the proposed windfall gains tax follow the link below.

https://www.dtf.vic.gov.au/windfall-gains-tax